Five Ways to Protect Your Bank Deposits

“Banking is very good business if you don’t do anything dumb.”

– Warren Buffett

Bank runs used to be called “panics,” and they were a heck of a lot more common than they are today. The recent collapse of SVB (Silicon Valley Bank) makes this topic relevant again. In this edition of The TwentyPercenter, we’ll break down what bank runs are, why they happen, and how you can keep your money safe.

What are Bank Runs?

Banks operate like gyms. Gyms operate on the assumption that everyone who has a membership won’t show up at the same time. If everyone shows up at 10am on Friday, the system collapses like a Crossfitter after a Murph Challenge. Banks work the same way. They operate on the “fractional reserve banking” system. Depending on the size of the bank, they may loan out as much as 90% of their deposits. It’s how they make money. So if everyone shows up at 10am on Friday, the system collapses and you have a bank run.

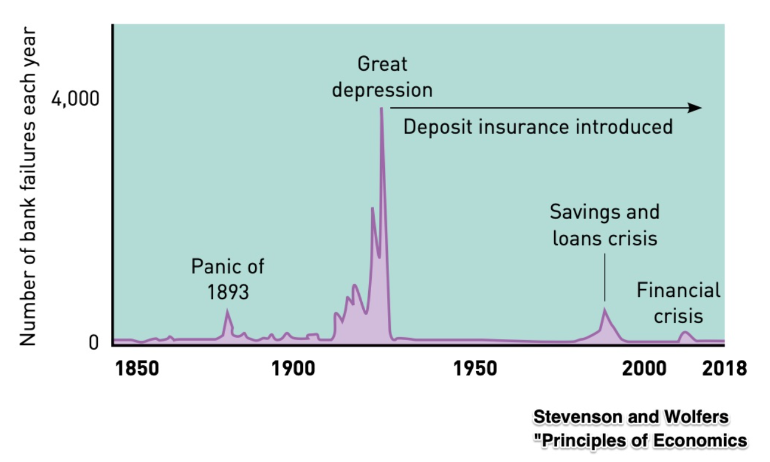

In the 1907 financial crisis, JP Morgan helped avert a run in part by instructing tellers to double-count withdrawals slowly. Afterwards the Federal Reserve Banks and fractional reserve banking rules were implemented to help stop future runs. Both helped banks, but didn’t solve the panic problem. Over 9,000 banks collapsed in The Great Depression when anxious depositors lost faith in the system. Imagine the Building & Loan stampede in It’s a Wonderful Life repeated 9,000 times! This led to the creation of the FDIC (Federal Deposit Insurance Corporation) to insure depositors’ money. They originally insured up to $5,000 (about $133,000 in today’s dollars.) The thinking was if people knew their money was insured, they wouldn’t all rush to withdraw it out when there were storm clouds on the horizon. Huzzah! They landed on a solution to the panic problem.

Banks still collapse. Every year a handful of banks go under. And every so often, extraordinary economic conditions create situations where many banks fail. Over 2,600 banks and credit unions failed in the Savings & Loan Crisis. And the Great Recession saw 489 banks collapse. Thankfully, these systemic failures are now rare.

Why Do Bank Runs Happen?

Bank runs happen when depositors think the bank is unstable and lose faith.

Sometimes there are real problems at the bank. Banks get into trouble for a variety of reasons. They can do business with the wrong clients, they can make bad loans or poor investments, they can mismanage their balance sheet, or any combination of the above. SVB managed a trifecta. Ben Thompson did a nice deep dive in Stratechery if you want a blow-by-blow of the collapse.

But not always. There is a perfectly plausible but possibly apocryphal story of a Hong Kong bank run in 1985. People saw long lines outside the bank. They assumed the bank was going under and everyone rushed to withdraw their money. The long line turned out to be from a neighboring pastry shop!

I was at a wine tasting event for SXSW the same weekend SVB went under. To the sommelier’s dismay, several tech founders were texting their teams trying to get their money out instead of learning the difference between new- and old-world wines. One confided in me that he had $500,000 in the bank and was torn about moving it to another bank. He didn’t want to create the kind of panic that drives bank runs. According to several reports, that very evening a couple of tech funds were instructing all their companies to get out of SVB.

In JP Morgan’s day, a bank run could be slowed by double-counting the bills. In 2008, with electronic wire transfers and national news, it took two weeks for Lehman Brothers to collapse. Now, with Twitter, Telegram, and group texts, it took less than 48 hours for SVB to go down.

A bank run is like a stampede. Lightning strikes. A steer bolts. Others assume something bad is happening and chase after the first. Pretty soon the whole herd is running for their lives.

How Do You Keep Your Money Safe?

Before I wade into ways to protect your money, a quick disclaimer: I do not have any financial licenses. I can’t provide any warranty or guarantee of the accuracy, completeness, or results from using the following information. You should consult your own legal, financial, or tax advisor, and verify all information to your satisfaction prior to taking any action. Got it? Good. Now let’s get to the important stuff.

The FDIC currently insures deposits by account holder and by account type up to $250,000*. Insured accounts include single accounts, joint accounts, corporate accounts, and some retirement accounts (like an IRA, pension plan, etc).

The vast majority of depositors are covered by these. And no one has lost money in these insured accounts since 1933. The FDIC may cover deposits above $250,000 when they deem a bank’s failure to be a “systemic risk.” It happened with SVB and in the Great Recession. But don’t count on it. With normal bank failures, deposits above the insured amount only get paid back from the sale of the bank’s assets. On average, about 27% of those uninsured funds are lost. And the losses aren’t meted out equally. Uninsured depositors have to apply and hope there are enough funds to cover their uninsured funds.

So when you have more than $250,000 in the bank, you need to get purposeful about protecting it. While there may be 50 ways to leave your lover, here are five ways to protect your money.

1. Divide Your Deposits Between Multiple Insured Accounts

If you divide your money between multiple accounts, you can increase your coverage. For example, you and your spouse could get $1.25M insured by leveraging just four accounts at an FDIC-insured bank. Each of you could have a checking account in your own name with $250,000 in each. You could also have a joint account with $500,000 in deposits. (You get $250,000 per co-owner of the account.) Finally, your amazing real estate business has its own account (held by the entity) with another $250,000.

2. Move Your Money to a “Too Big to Fail” Bank

There is no formula that says a bank is “too big to fail.” Officials have to believe a bank’s failure would create “systemic risk” to the bank sector. That said, most community banks or regional banks wouldn’t normally meet the criteria. SVB is an example of a regional bank that got promoted to the bigs. SVB had a bunch of high-profile clients and there is a general unease around the economy with inflation and recession fears. So the FDIC stepped in and declared they were covering 100% of the unsecured deposits to head off the stampede.

Most of the big national banks would likely meet the “too big to fail standard.” But there are no guarantees. A client of ours works at one of these giant banks. She shared they onboarded over 2,000 business accounts the week SVB collapsed.

3. Open Accounts at Multiple Banks

This is basically taking strategy #1 and repeating it with separate banks. It works at credit unions too. The National Credit Union Administration acts like the FDIC for credit unions. So you could have $1.25M at a community bank, another $1.25M at a credit union, another $1.25M at a regional bank. Rinse and repeat.

The trouble with this strategy is that it is impractical for people or businesses with big cash reserves.

4. Leverage a “Deposit Distribution” Tool

Some banks will handle strategy #3 for you (e.g., MaxSafe at Wintrust or IntraFi Network Banks). If your business is big enough to need several million in reserve accounts, the bank spreads funds over more than a dozen banks on your behalf. You get the simplicity of dealing with one bank and they move your money around to keep it all insured.

5. Use a Sweep Money Market Mutual Fund

Lots of wealthy people and cash rich institutions have sweep accounts. Sweep accounts move your money to interest-bearing accounts overnight so your reserves can earn a little interest. While financially smart, these accounts won’t protect your money above FDIC-insurance limits if the bank goes under.

A sweep money market mutual fund is the answer. It takes these funds and invests them in mutual funds not held by the bank. You can even pick the mutual funds. Your cash is protected from a bank collapse and is available on relatively short notice. These accounts can come with monthly fees and transaction fees and the yield will depend on the fund you choose. So breaking even or earning a return can be a moving target. If you have about a $1M to protect, it’s worth looking into. If you’re fretting about the fees, just remember this is a wealth protection strategy, not an investment tactic.

Hopefully this is all advice you can take to the bank. There are other strategies like trust accounts that you are welcome to explore with your financial advisor.

One question to ponder in your thinking time: Do I have a wealth protection strategy that I trust?

Make an Impact!

Jay Papasan

Co-author of The One Thing & The Millionaire Real Estate Agent

*Cool fact: FDIC-insured banks pay fees to the FDIC to fund these rescues. In big crises, the government provides extra funds but the money is generally paid back over time. The banks are basically self-insured. As such, bankers don’t look favorably when their peers run a bank into insolvency. It raises fees for them all. The system is pretty smart and has done a pretty good job since 1933.